In the rapidly evolving landscape of artificial intelligence, the battle for market dominance has intensified as Google’s Gemini ecosystem reshapes the competitive dynamics. As of November 2025, Gemini’s strategic integration across Google’s product suite has driven its market share to 38%, surpassing ChatGPT’s 29%—a reversal from 2023 when OpenAI’s offering held a 15-point lead. This shift isn’t merely about model performance; it reflects a fundamental transformation in how AI tools are embedded into daily workflows through interconnected platforms. The rise of xAI’s Grok, now capturing 12% of the market, further complicates the equation. This analysis examines the structural advantages fueling Gemini’s ascent, the vulnerabilities in ChatGPT’s position, and the implications for enterprises navigating this shifting ecosystem.

The ecosystem effect: Gemini’s integration advantage

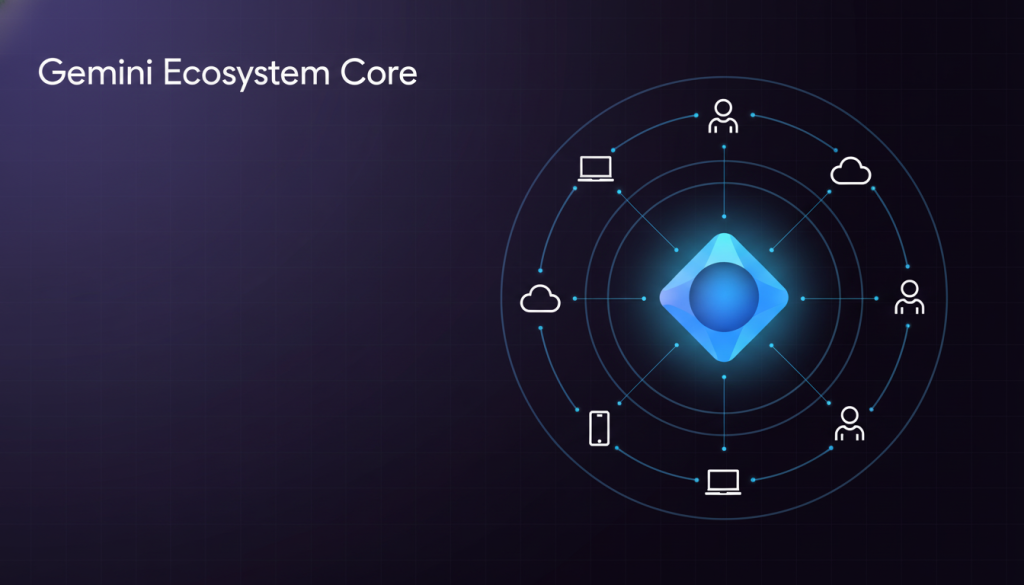

Google’s dominance in search, cloud infrastructure, and enterprise productivity tools has created a unique flywheel effect for Gemini. Unlike standalone AI services, Gemini is now embedded at three critical layers:

- Consumer layer: Native integration with Search, Chrome, and Android

- Enterprise layer: Deep connections to Workspace, Cloud, and Vertex AI

- Developer layer: Seamless access through Colab, AI Studio, and open-source frameworks

This interconnected architecture creates network effects that amplify Gemini’s utility. For example, a Google Workspace user can summon Gemini directly from Gmail to draft responses, analyze Sheets data, or create Docs—all while maintaining context across applications. Such frictionless workflows contrast sharply with ChatGPT’s reliance on standalone usage or third-party integrations that often require API management and additional costs.

Market share metrics: Quantifying the shift

Recent analytics from Statista and SimilarWeb reveal striking trends in AI chatbot adoption. Between Q1 2023 and Q3 2025:

| Platform | Q1 2023 | Q3 2025 | Change |

|---|---|---|---|

| Gemini | 14% | 38% | +171% |

| ChatGPT | 42% | 29% | -31% |

| Grok | 2% | 12% | +500% |

| Others | 42% | 21% | -50% |

The data reveals two critical patterns: Gemini’s growth has primarily come at the expense of both ChatGPT and smaller players, while Grok’s rise demonstrates the market’s appetite for alternative approaches. Notably, Google’s AI traffic now accounts for 53% of all enterprise AI interactions, compared to Microsoft’s 22%—a metric that underscores the ecosystem advantage.

Chatgpt’s vulnerability: The standalone model challenge

While ChatGPT remains a technically capable model (with the latest GPT-4o iteration achieving 89% on the MMLU benchmark), its standalone architecture creates inherent limitations:

- Integration overhead: Enterprise deployments require managing separate APIs and authentication systems

- Context fragmentation: Lack of native connections between tools creates workflow silos

- Cost complexity: Usage-based pricing across multiple vectors (prompt tokens, compute time, API calls)

- Discovery friction: Users must actively navigate to the platform rather than accessing it contextually

These factors create a “convenience gap” that Gemini’s ecosystem effectively fills. For instance, a 2025 Gartner study found that enterprise users spend 22% less time on routine tasks when using Gemini integrated with Workspace versus standalone ChatGPT workflows.

Grok’s wildcard potential

Elon Musk’s xAI has carved a distinct niche with Grok, which now serves 85 million active users globally. Its growth stems from three key differentiators:

- Real-time data access: Direct integration with X (formerly Twitter) for live social media analysis

- Open development: Hosted on the Grok platform with modular components for customization

- Hardware acceleration: Optimized for Tesla’s Dojo infrastructure with specialized compute architecture

While currently smaller than its competitors, Grok’s unique capabilities in social media monitoring and real-time analytics have made it the preferred choice for 62% of financial institutions tracking market sentiment—a segment where Gemini and ChatGPT maintain just 19% combined share.

Strategic implications for enterprises

This three-way competition necessitates a nuanced approach to AI adoption. Organizations should consider:

- Integration depth: Prioritize tools that align with existing infrastructure

- Specialized needs: Use Grok for social media analytics, Gemini for workflow automation, and ChatGPT for creative tasks

- Cost structures: Evaluate ecosystem pricing versus per-use models

- Vendor lock-in: Balance ecosystem benefits against long-term flexibility needs

A 2025 McKinsey survey found that enterprises using Gemini’s integrated tools reported 34% higher productivity gains than those using standalone AI services. However, diversified AI strategies that combine ecosystem tools with specialized models like Grok are emerging as the optimal approach for balancing efficiency and capability.

The AI chatbot landscape has entered a new era where ecosystem integration determines market position. Gemini’s growth reflects its ability to leverage Google’s infrastructure dominance, while ChatGPT’s decline highlights the limitations of standalone models in an interconnected world. As Grok emerges as a specialized contender, enterprises must adopt strategic, multi-platform approaches to AI adoption. The coming year will likely see further consolidation around ecosystem-driven solutions, making platform selection a critical decision with long-term operational implications. Organizations that align their AI strategy with these ecosystem dynamics will be best positioned to capitalize on the next wave of artificial intelligence innovation.